Intro #

I’ve been serious about budgeting for the past 15 years, and for the past 8 years I had been using You Need a Budget (YNAB). After yet another price increase, I decided to look for free and open source options which led me to Actual Budget which has been a great improvement.

Why I didn’t want a YNAB budget #

What set me down my path of YNAB alternatives was an announcement of a price increase. Out of curiosity I looked up my payment cost over the 8 years:

| Year | Cost | Δ ($) | Δ (%) |

|---|---|---|---|

| 2018 | $75.59 | - | - |

| 2019 | $75.59 | $0.00 | 0.0% |

| 2020 | $83.99 | $8.40 | 11.1% |

| 2021 | $83.99 | $0.00 | 0.0% |

| 2022 | $98.99 | $15.00 | 17.9% |

| 2023 | $98.99 | $0.00 | 0.0% |

| 2024 | $98.99 | $0.00 | 0.0% |

| 2025 | $109.00 | $10.01 | 10.1% |

Over the 8 years I had used YNAB, the price increased a total of 44.2% which has outpaced inflation. Inflation from 2018-2025 was roughly 28% based on the CPI inflation calculator.

Cost wasn’t the only factor though, I also frequently experienced issues with the bank syncing they used. Every budget software needs to either have transactions imported automatically, or manually input transactions. YNAB’s privacy policy lists several providers (“MX, Plaid, TrueLayer, etc.”) and having many options of data aggregators means that they are able to support more banks. This is good, but somewhere in their logic it failed to sync my banks regularly. For instance, I had two cards from the same bank and every time I made a payment on card-B, it would be applied to card-A. Then I had a third card which I had to manually authenticate every time I wanted to sync data and this authentication would require 3-5 minutes and two 2FA codes.

Actual Budget: 3 months experience #

Actual Budget looked like a promising alternative:

- Free and open source software

- I pay the bank aggregator directly if I want to use a sync service ($15/year, compared to YNAB’s $109/year)

This was enough for me to decide to set up Actual Budget on my server to give it a try.

Easy to install #

I found the installation was easy to follow. I also followed their instructions to set up the SimpleFin Bridge (U.S. users) which let me easily set up bank syncing. This is where the differences between YNAB and Actual Budget started becoming apparent.

No more issues #

While setting up SimpleFin Bridge for bank syncing, I was able to attach specific accounts at my bank with specific cards. Unlike YNAB where there was some logic that would confuse my cards at the same bank, Actual Budget+SimpleFin Bridge resolved this completely. In the three months I have been using Actual Budget, I haven’t had one mixed up transaction whereas before I dealt with this weekly on YNAB. I also have not experienced any more authentication issues with one of my cards. Everything just works.

Cheaper #

As mentioned, I pay the bank aggregator directly which for me is $15/year compared to YNAB’s $109/year. Since the bank aggregator is optional, Actual Budget could be used completely free, but I find that the $1.25/month is worth not needing to manually input or import transactions from files.

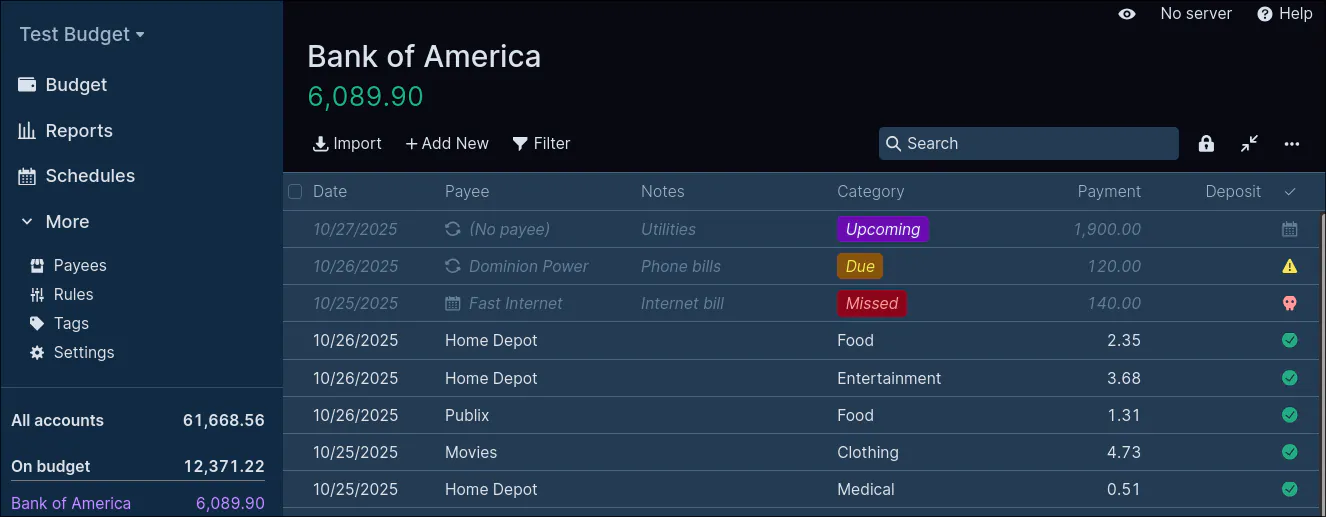

More Robust Rules #

One of the things that bugged me about YNAB was the transaction categorizations. At the time I didn’t realize it but they are a black box. There was no way for me to easily find where these rules are, and what kind of logic is behind them. With Actual Budget, this is as simple as going to their Rules page. Rules are made automatically when you tag transactions, like in YNAB, but you can also edit those rules or make your own rules to categorize transactions, add notes, update the payee, and more. The most common rules I use are setting categories and also linking schedules (see next section). The transparency and control over what these rules do though was something I didn’t know I was missing until I had it.

Better Schedules #

Schedules are the biggest game changer for me. Schedules allow you to set up recurring payment/deposit templates that automatically match and link to transactions as they come in. YNAB does allow you to schedule transactions and make them recurring; however, Actual Budget’s implementation is better because:

- You can view all scheduled transactions across all accounts via the

Schedulespage - More customization in matching rules to capture amounts that vary each month (like utility bills)

- Manually link transactions to schedules if auto-matching misses one (then refine the schedule)

- Easily view a schedule’s entire transaction history

Actual Budget’s schedules feel more complete to me–they help bridge budgeting (planning ahead) and expense tracking (categorizing as expenses occur).

Reports #

Out of the box, Actual Budget has more reports built in. YNAB had shockingly few reports even after 8 years, and relied on a community plugin (Toolkit for YNAB) to extend the basic reporting into something useful. Actual Budget lets you modify your reports page with prebuilt graphs, and it also allows you to build custom reports.

Conclusion #

There are many other things Actual Budget has to offer but these were some of the highlights for me. Overall, I have had no problems with Actual Budget over the past 3 months. Not only is it vastly cheaper, Actual Budget also has added meaningful improvements to help me actually budget just as the name suggests. I highly recommend Actual Budget.